We are trying something new here at 1911 Trust – a real time, short form blog to share our insights and thoughts on the market. These will vary in length and topic, and we hope you find these pieces to be informative as you follow the markets and make investment decisions. If there are specific topics you are interested in hearing more about, please let us know and we will do our best to incorporate into future posts.

Today’s post: lessons from Bill Belichick that can be applied to investing, and 5 key data points to watch in today’s market.

With summer now turning to fall, and football season now in full swing, today’s post will feature a key lesson I learned in my first job. Before I embarked on a career in investing over a decade ago, I was very fortunate to spend 4 years working for Bill Belichick and his staff in Football Operations for the New England Patriots (followed by one year as an assistant coach for Harvard).

Despite being one of the lowest people on the totem pole in the Patriots organization at 22 years old, I learned a lot from spending so much time in the most successful professional sports franchise in the country, and many of these lessons have paid dividends in the investment world.

Each day when we entered the facilities at One Patriot Place, we were greeted by a sign that laid out four requirements when you work for the Patriots:

When you come here:

- Do your job

- Work hard

- Be attentive

- Put the team first

Great lessons to live by for anyone working on a high functioning team in any industry, and pieces of advice that I have shared with countless analysts that I have coached and mentored over the last decade.

While Coach Belichick is perhaps best known for the phrase “do your job”, what I want to talk about today is the sign we read when we left the building each night:

When you leave here:

- Don’t believe or fuel the hype

- Manage expectations

- Ignore the noise

- Speak for yourself

I will start with “speak for yourself”, partially as a compliance disclaimer – the opinions set forth in this post, as well as all future posts, are solely my own opinion and do not necessarily represent the opinions of The 1911 Trust Company.

In today’s investment world, the 3rd requirement from Coach Belichick, “ignore the noise”, is becoming ever more important to achieving one’s financial goals. We are inundated daily with more data points, more media coverage, more “experts” calling for the next financial crisis, and more reasons to abandon a disciplined, long-term oriented investment strategy in favor of repositioning for the risks and opportunities in front of us at this very moment.

Over the last 5 years, we have not been short on near-term noise and volatility in markets. COVID lockdowns, a mini-bubble in “stay at home” beneficiaries, the 2020 election, the reopening trade, inflation, rising interest rates, calls for a recession, Russia/Ukraine, regional banking crisis, commercial real estate crash, Israel/Hamas, and more calls for a recession.

After all of this, we now have another tightly contested (according to the polls) presidential election in November. The hype machine is heating up, and we will hear from both sides why one candidate is better for the markets and economy than the other candidate.

Investors will be well served to ignore the noise and stick to the plan. Over the last 5 years, despite all of the risks laid out above (including the 2020 election), the S&P 500 has returned +83% and the Nasdaq has returned +137%. None of these “black swans” derailed the market for any more than a year.

We get paid to analyze the markets and have opinions, and simply saying “all of this is noise” can feel unsatisfactory. While our team analyzes hundreds of datasets and viewpoints (some of which we will share in future posts), I will lay out the top 5 indicators that I am watching to determine the near-term path for markets and the economy, and what these indicators are telling us now. We can place others (including election rhetoric) into the “noise” category for the time being (of course, this can evolve over time).

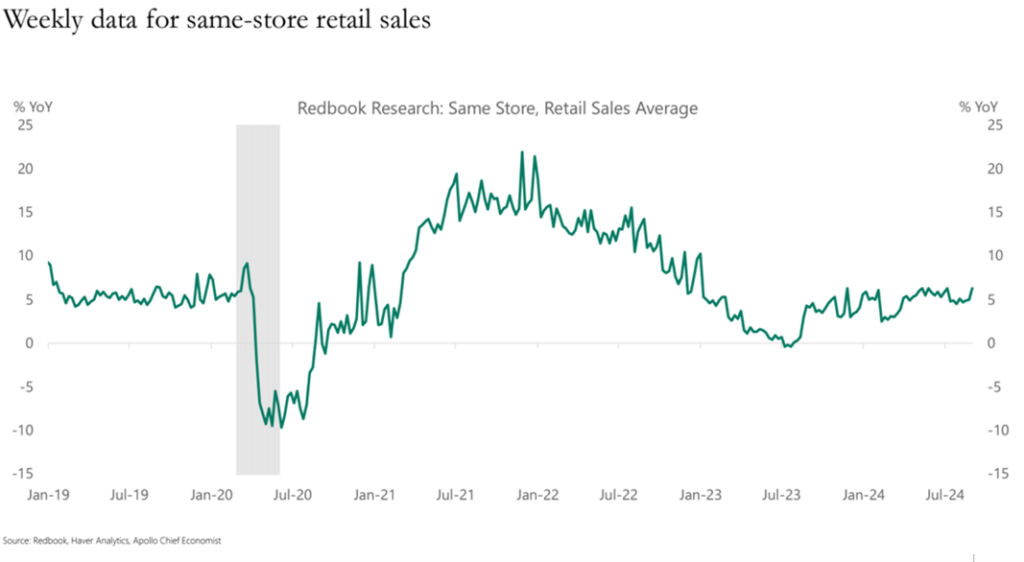

#1 – People are spending money

Retail sales are growing at a 5%+ clip over the last year, which is meaningful as consumption is 70% of US GDP.

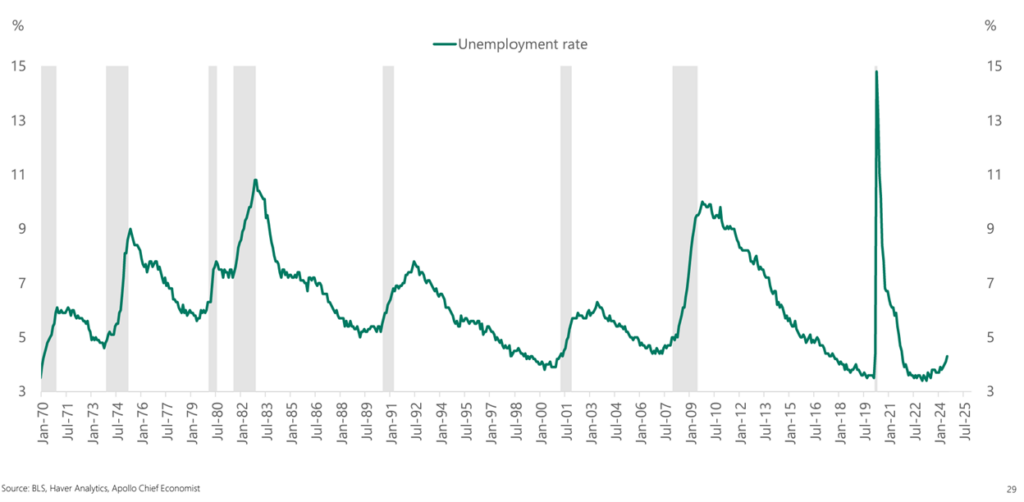

#2 – People can continue to spend money because America is near full employment

The unemployment rate, at 4.2%, is low by historical standards, albeit slightly above where it was 2 years ago when we had a severe labor shortage.

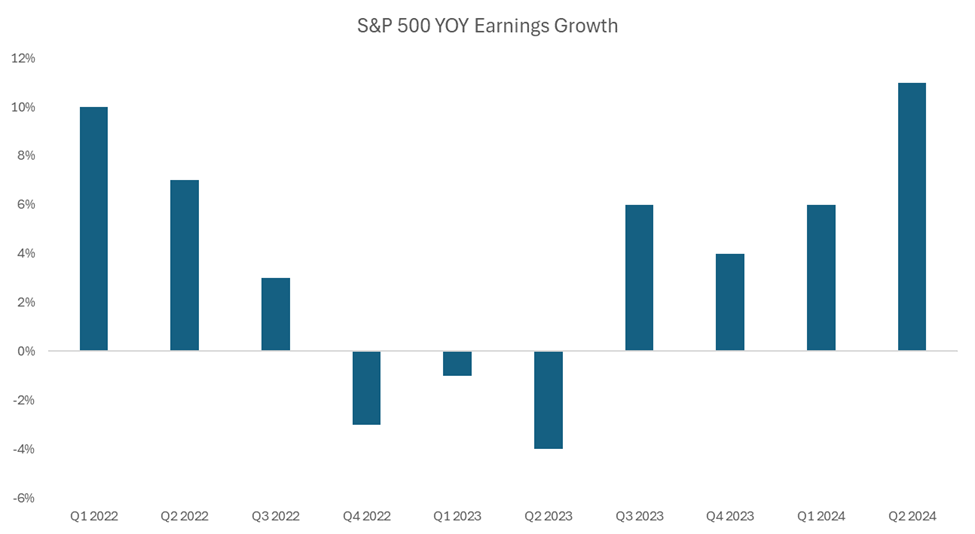

#3 – Corporate earnings remain strong which is a positive sign for the labor market

The S&P 500, an index of the 500 largest publicly traded companies in the US, grew their profit by over 10% in Q2. This is the best growth rate in over 2 years, so there is not a lot of pressure for businesses to lay off workers.

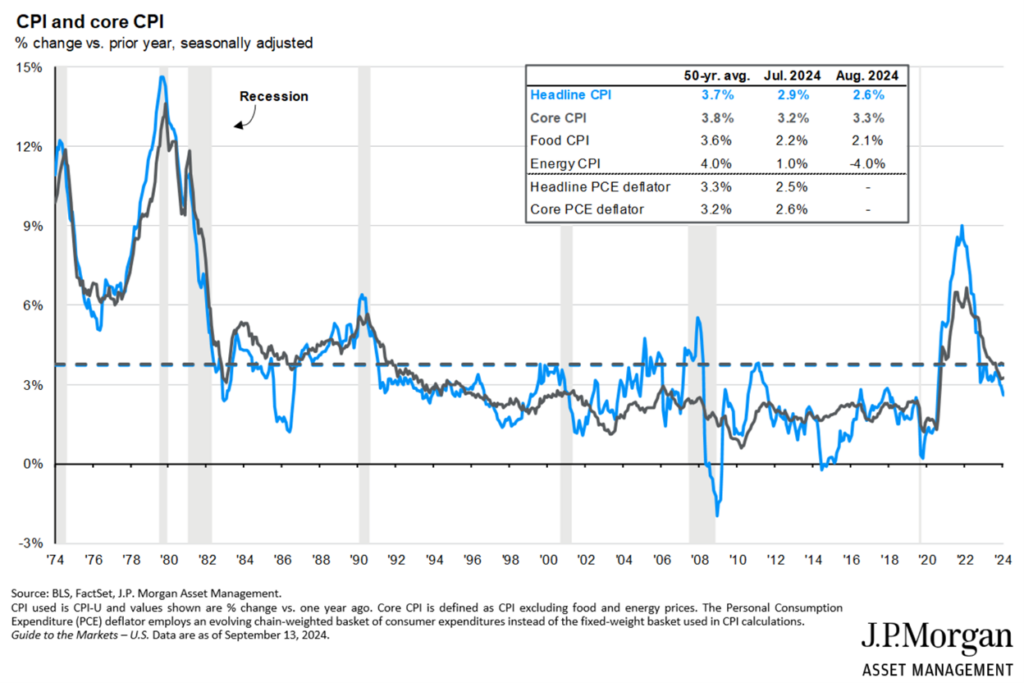

#4 – Inflation continues to decline

Inflation has been a challenge to the global economy over the last 3 years, which has created concern among investors that the Federal Reserve would need to engineer a recession via higher interest rates to slow down the rise in prices. Over the last 18 months, inflation has declined from 9.1% (mid-2022) to 2.6% today. This downward move in inflation is allowing the Federal Reserve to finally lower interest rates, which tends to boost economic activity.

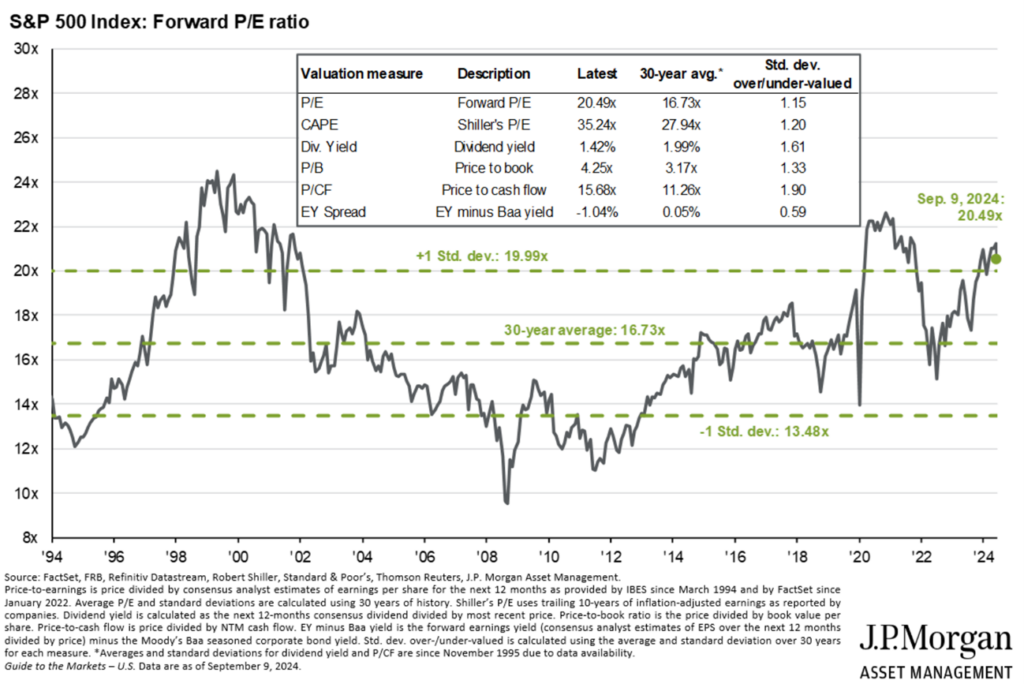

#5 – While corporate earnings are strong, the valuation of the market is fairly elevated

The S&P 500 Price/Earnings multiple, which is a measure of how expensive the market is relative to its profit level, is fairly elevated at 20.5x earnings. Before the dot-com crash of 2000, the NASDAQ (not pictured), which tracks faster growing innovative companies, traded at 80x earnings in 2000 vs. 25x today. The S&P 500 traded at 24x forward earnings on the eve of the dot-com crash. The S&P 500 would need to appreciate by 20% from here, with no earnings growth, to reach this level of valuation:

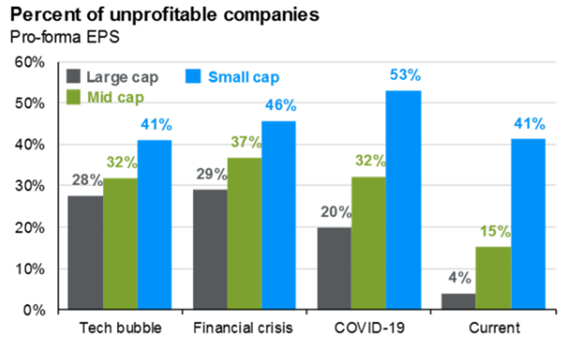

Additional context on valuations is warranted

Today’s market features much higher quality businesses than the 2000 dot-com bubble. In 2000, 28% of large cap stocks were unprofitable vs. just 4% today, and other measures such as free cash flow, profit margins, and return on equity are much better today than in the past.

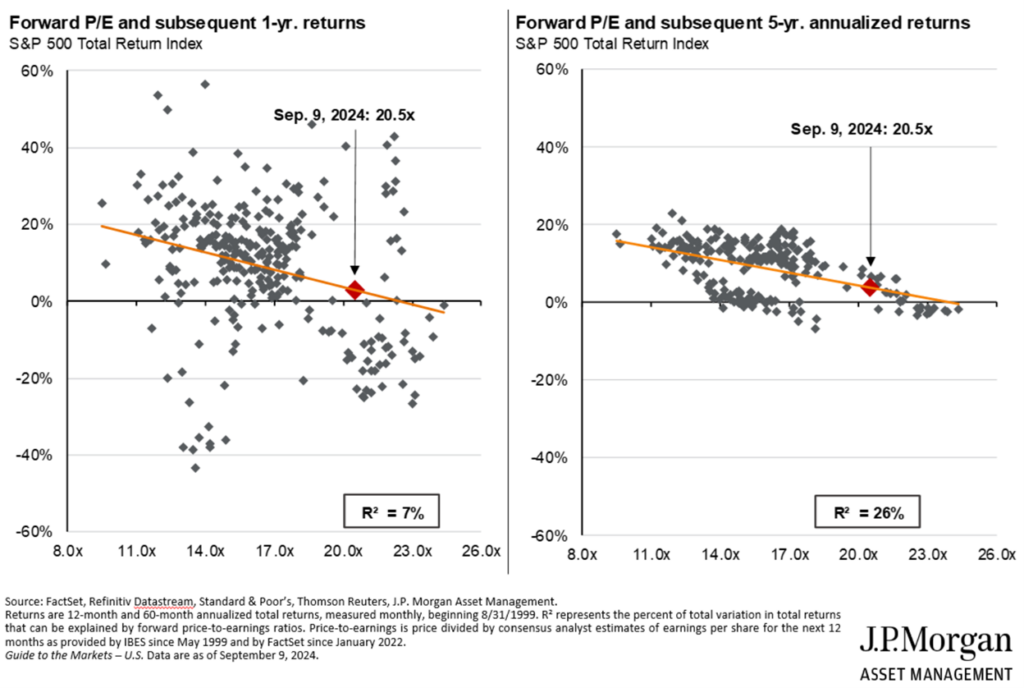

While elevated valuations could lead to somewhat lower long-term returns, valuations are not a great indicator of returns in the near-term (in other words, selling stocks because the market valuation is high doesn’t always work). There is a 7% correlation (out of 100) between the P/E ratio and 1 year returns, and only a 26% correlation between the P/E ratio and 5 year returns.

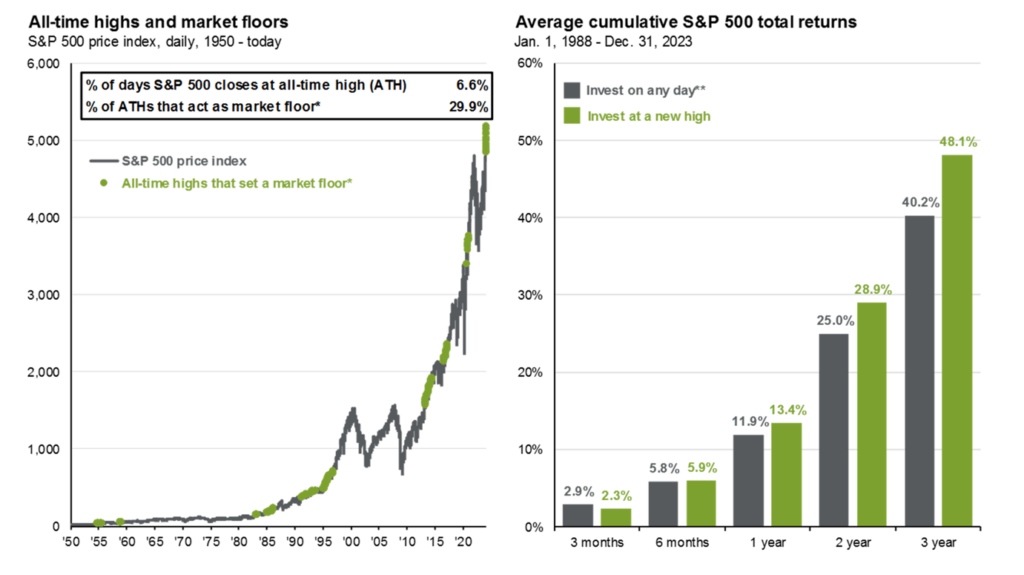

Nearly every market participant has heard the phrase “buy low, sell high”. While that is a good place to start (better than buying high and selling low), unfortunately it is not that easy as a long-term investor with real financial goals. Sitting in cash waiting for a market crash can lead to years of forfeited returns in one’s portfolio. Data from JP Morgan shows that investors historically have not needed to fear a market that is at all-time highs. Their analysis points out that forward market returns are actually higher when you invest at an all-time high than if you invest on any other day in the market. While we are not advocating that anyone “back up the truck” and pile into stocks at these levels, we are also not running for the exits either.

Putting it all together…

The economy generally looks pretty healthy, albeit slowing from overheated levels 2 years ago. I remain fairly constructive on the market today, although slightly less bullish than I was 12-18 months ago when valuations were lower. If the unemployment rate rises from this level, corporate earnings disappoint, or if the downward path of inflation reverses, that would be a cause for concern. There is less room for error for the stock market given valuations, but as long as the economy remains stable, and absent any macro shocks, the market can continue to deliver at least average rates of return over the coming years.