Reaction to the 2024 US Presidential Election

After a historic election cycle filled with a series of unprecedented twists and turns, Election Night 2024 provided far less suspense and drama than many expected. While we suspect that half of our readers are disappointed in the results, and the other half excited, our job is not to opine on whether America made the correct choice, but rather to invest prudently and navigate what lies ahead in President Trump’s second term in office.

Early signs are that the market is breathing a sigh of relief that the election results were clean and decisive, with the S&P 500 posting a new all-time high, and many sectors touted as “Trump beneficiaries” are soaring (banks, small-cap stocks, crypto assets, and the like). We will lay out below our key takeaways from this election outcome and what it means for long-term investors.

Don’t mix political views with investing

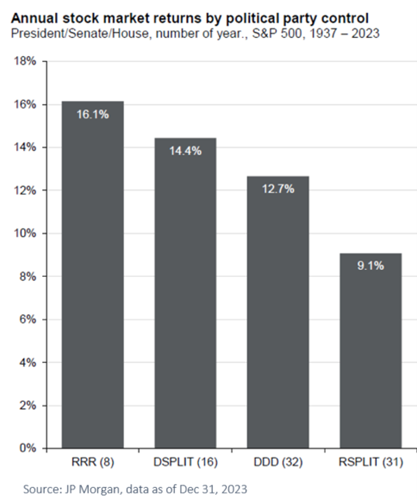

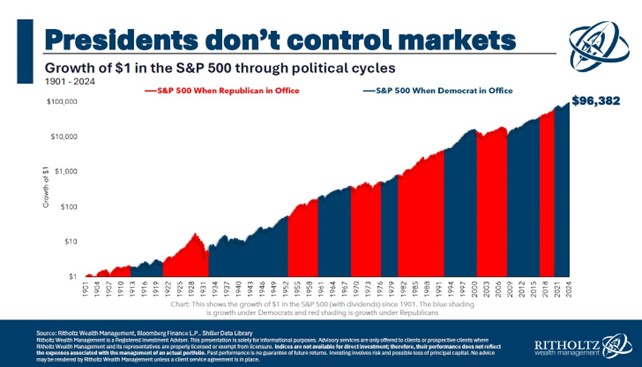

As discussed in our first market insights post, Ignore The Noise, mixing politics and investing can often be a fool’s errand. While much ink has been spilled over the last year regarding which president will be better for markets and the economy, the reality is that short-term market performance and economic growth is much more complicated, with the key drivers often being out of the President’s control.

And over the long-term, markets have performed well regardless of which party is in power. Ultimately, stock prices follow fundamentals, and the earnings of corporate America are the key driver of market returns.

Tread carefully when projecting policy narratives into stock performance

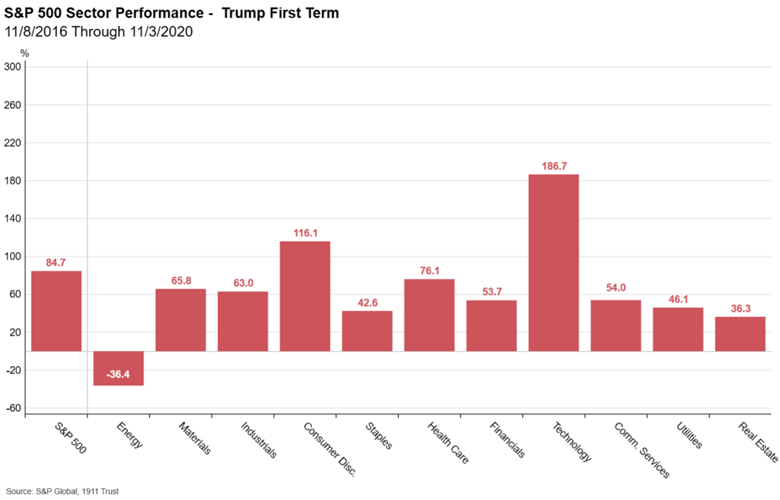

Despite the seismic market reaction this morning in “Trump beneficiary” stocks, the intuitive answer on how to invest based on who wins an election is often faulty. Going into the 2016 election, the common logic was that a Trump presidency would be a boost to financials, energy, and industrials. There was less enthusiasm for technology and healthcare. However, earnings and fundamentals won out over Trump’s 4 years in office, with technology (+187%), consumer discretionary (+116%), and healthcare (+76%) leading the market in Trump’s first term, while energy (-36%) was the worst performing sector.

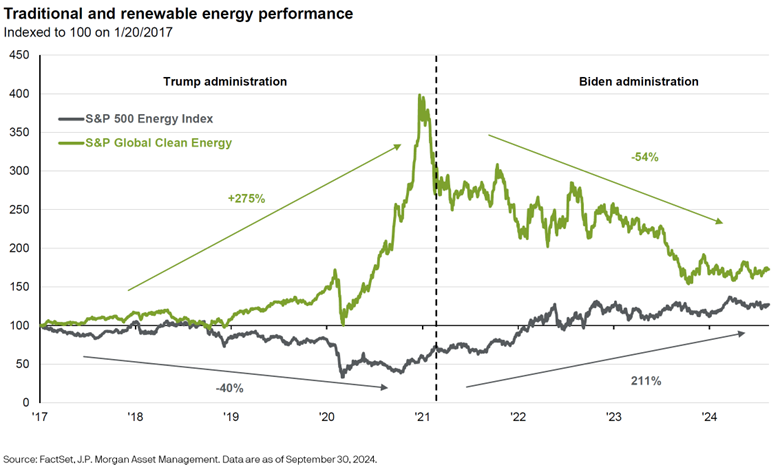

The performance in the energy complex was particularly noteworthy when compared to Biden’s term in office. Many expected in 2016 that a Trump presidency would save the oil & gas industry at the expense of renewables. Conversely, in the 2020 election, a Biden victory would spell the end of fossil fuels, and renewables would thrive.

The opposite happened. Clean-energy sectors performed extraordinarily well under President Trump while the energy sector struggled. And during President Biden’s term in office, the energy sector performed very well while many renewables businesses saw their share prices get cut in half.

Private Equity and Venture Capital could benefit from the election outcome

Despite these warnings to avoid projecting policy stances into market returns, there are some important developments expected under a second Trump presidency that can impact company fundamentals, both positively and negatively.

On the positive side, the private equity and venture capital space should have brighter days ahead after a difficult 3 years. With the IPO market screeching to a halt after record years in 2020 and 2021, many venture backed companies rely on acquisitions by large-cap technology companies with deep pockets and an appetite for deal-making in order to generate realized returns for VC investors.

However, the regulatory environment has not been accommodating to mergers and acquisitions over the last 3 years. With FTC chair Lina Khan, a Biden appointee, in charge of enforcing US antitrust law, big-tech acquisitions of smaller companies has dropped 49% versus pre-COVID levels. This decline is not for lack of trying, with several notable mergers abandoned due to regulatory pushback (Adobe’s $20bn acquisition of Figma, Amazon’s proposed acquisition of iRobot, Nvidia’s acquisition of Arm, among others).

Even before the recent slow down in IPO activity, mergers and acquisitions were the primary exit path for venture backed companies for much of the 21st century. According to data from the National Venture Capital Association, acquisitions have accounted for 90% of exits for venture backed companies for much of the last decade. In the early 1990s, this figure was only 30%. A lighter regulatory touch from US antitrust regulators should bode well for venture capital exits in the coming years.

Fiscal policy and global trade will be in focus

In the public markets, there are a number of other proposed policies from the Trump campaign that could negatively impact certain parts of the market, but the devil will be in the details. We continue to monitor closely both the domestic fiscal policy agenda as well as the global trade strategy.

On the domestic side, it is widely anticipated that the 2017 tax reform bill from the Trump administration, much of which was due to sunset in 2025, will be mostly extended. There is likely to be some tweaking on the edges but the general direction is toward maintaining the tax rates that were put in place under Trump’s first term, which should benefit corporate earnings.

However, the US debt load held by the public, which stands at 95% of GDP, was unfortunately not a major area of focus during the race for either campaign, but will be an important input to any discussion around reducing taxes. If tax revenue is reduced without some offset of lower government spending, this would potentially lead to higher inflation which would be a net negative for equity and bond markets.

On global trade, the size and scope of potential tariffs will be front and center as we analyze the potential impact on multinational earnings and inflation. Widespread tariffs would likely be a net-negative for both corporate earnings and the inflation outlook, but we caution against pre-mature conclusions until we see actual policy put in place.

Under Trump’s first term, the US collected $80 billion in new tariff revenue according to the Tax Foundation, which was lower than figures initially discussed. These tariffs largely stayed in place under President Biden. With this backdrop of a more hawkish trade policy over the last 8 years, the stock market has continued to perform well and corporate earnings are at record highs. Additionally, inflation under President Trump’s first term averaged a benign 1.9%. However, we continue to monitor global trade policy closely in the event that Trump 2.0 brings a more aggressive set of policies that lead to different outcomes than Trump 1.0.

Stick to the long-term plan

These topics above are a sampling of what we could expect under the Trump administration from an economic policy perspective. We anticipate there will be other curveballs and surprise proposals along the way. Ultimately, our North Star remains long-term fundamentals, and we believe investors will be best served by sticking to your investment plan and avoiding investing based on narratives during what should be an active legislative agenda over the next several years.