Our view on public and private markets heading into 2025.

It’s that time of year again. No, we are not talking about holiday shopping. It is the time of year when all of the experts on Wall Street take out their crystal balls and tell us what the stock market will deliver to us over the next year, down to the dollar.

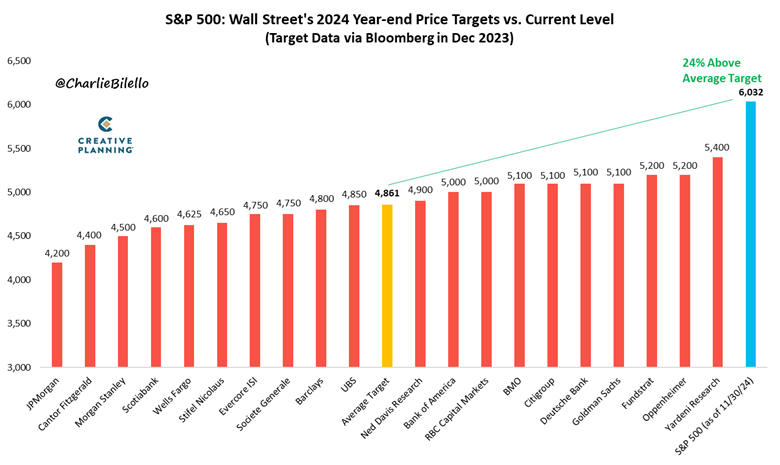

Last year, Wall Street strategists gave us an average price target for the S&P 500 of 4,861 at the end of 2024, with a range of 4,200 to 5,400. The market began 2024 at 4,770, meaning the average forecast called for a +2% return this year, with a range of -12% to +13%. So in general, most strategists were cautious at best, or in many cases outright bearish.

As the chart below shows, these forecasts missed the mark, which is par for the course in this annual exercise. At the end of November, the S&P 500 traded at a price of 6,032 and delivered a +27% return this year, which is +24% above the average target from the best and brightest in the investment industry.

Source: Bloomberg, Creative Planning

We don’t say this to suggest that these strategists don’t know their stuff. These are incredibly well-resourced firms that employ top talent and analyze markets with extraordinary depth. What 2024 showed us yet again was that predicting short-term market returns is no easier than correctly picking the winner of next year’s March Madness tournament.

So our 2025 outlook will not have a price target on the S&P 500 for 2025 (we do set price targets as a team at 1911 for fun/bragging rights but we will not be publishing those results). Instead, we will share what we see in the data currently and what type of market we are prepared for in 2025.

In general, economic data looks relatively healthy and it is hard to see signs of a recession in the near-term. However, there has been a lot of good news priced into the stock market and expectations are high, so we enter 2025 with a cautious view on near-term public equity market performance. Despite this view, we remain convicted of the belief that long-term investors are best served by having high exposure to the equity markets.

The picture looks a bit better in private markets, which are poised for a better 2025 than what we’ve experienced over the last 3 years.

Economic data does not point to near-term recession

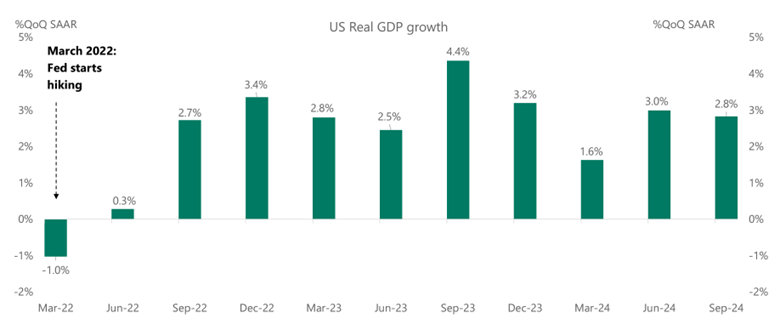

Since the Federal Reserve began a historic rate hiking cycle in 2022, the question everyone has been asking is “where is that recession we were promised?” In October 2022, Bloomberg’s recession probability model, which includes surveys from Wall Street economists as well as economic data, forecasted a 100% chance of a recession within 12 months. Yet, the US economy has continued to chug along at a ~2-3% growth rate.

Source: Apollo, BEA, Haver Analytics

While there are several underlying reasons why the US economy has remained resilient, the primary factors boil down to the health of the consumer, which makes up 70% of GDP. While inflation certainly has taken a toll on US households’ purchasing power, US households have not slowed down on spending, and that has boosted GDP by anywhere from ~1-3% per quarter.

How is this possible? A few reasons:

- Households took advantage of low interest rates in 2020-2021 to either pay off debt or take out cheap mortgages and are still reaping the benefits

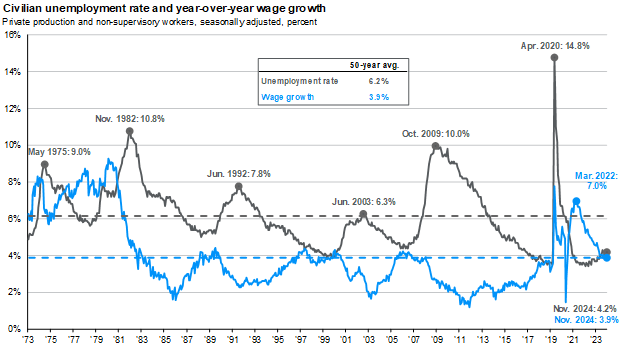

- Unemployment remains low relative to history

- Wages have kept up with prices

- The US government has continued to provide stimulus to the economy with the federal budget deficit currently running near 7% of GDP

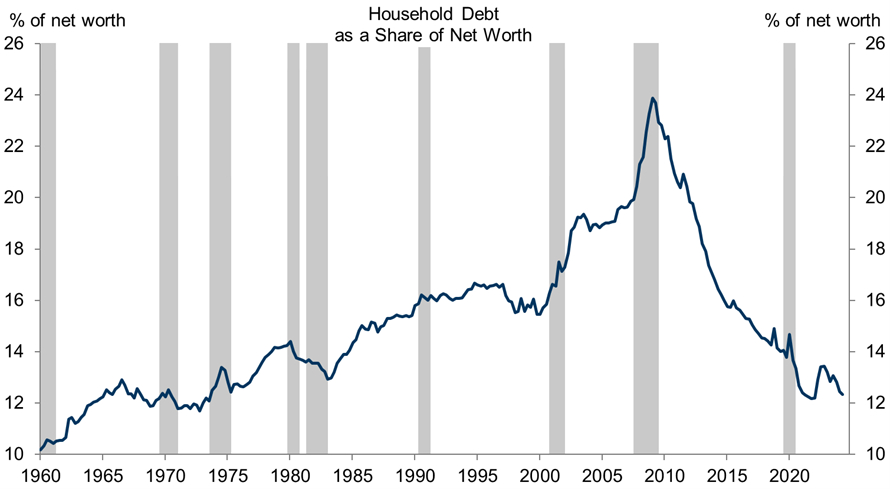

On the first point, household balance sheets have rarely looked better, with household debt as a share of net worth near its lowest levels since the early 1970s.

Source: Goldman Sachs GIR

And in the labor market, unemployment is hovering around 4.2% (2 percentage points below the 50 year average) and wages are growing at 3.9% year over year (in line with the 50 year average, and much higher than the current rate of inflation).

Source: BLS, FactSet, J.P. Morgan Asset Management. Private production and non-supervisory jobs represent just over 80% of total private nonfarm jobs.

While it is nice to look at positive backward-looking data, the real-time data points we are observing suggest that this healthy labor market can continue into 2025, which should bode well for the economy.

Job openings remain higher than any period from 1973 to 2020, despite falling from the artificially high levels of 2022 (during the post-COVID labor shortage). And while layoffs have ticked up a bit from 2021, they remain in line with historical averages.

Based on this data as well as other key inputs we track (default rates, retail sales, and more), it remains difficult for us to predict a near-term recession, but we acknowledge the economy can change course quickly, so we will continue to watch the trends in the above data and reserve the right to change our minds as the facts change.

We are also keeping close tabs on the policy agenda of the Trump administration – we expect a flurry of headlines related to tax policy, tariffs, and geopolitics in the coming months. Some of what we’ve heard so far could be positive for the economy (e.g. tax policy and deregulation) while others may present problems for economic growth and inflation (e.g. tariffs).

We learned in 2024 that the market oftentimes ignores geopolitical headlines, and given the wide range of potential outcomes in all of these policy ideas, our approach is to wait and see more concrete proposals before expressing a more informed view on the potential impact to the economy.

The stock market is not the economy

This is one of the most important lessons of the last 5 years. We learned this in Q2-Q3 2020 when the global economy remained largely locked down while the stock market raced to new all-time highs, erasing a COVID-lockdown induced -35% drop in a matter of months. We learned this again in 2022 on the opposite end, when the stock market fell -27% despite the US economy not experiencing a recession.

Why is this investment adage important in 2025? While we see the economy remaining generally healthy, there are a number of reasons why a cautious stance in the stock market could be appropriate in 2025.

To start, the market has had an extraordinary run over the last 2 years, with the S&P 500 returning +58% since the start of 2023 and the Nasdaq nearly doubling with a +96% return. It may be time for a breather.

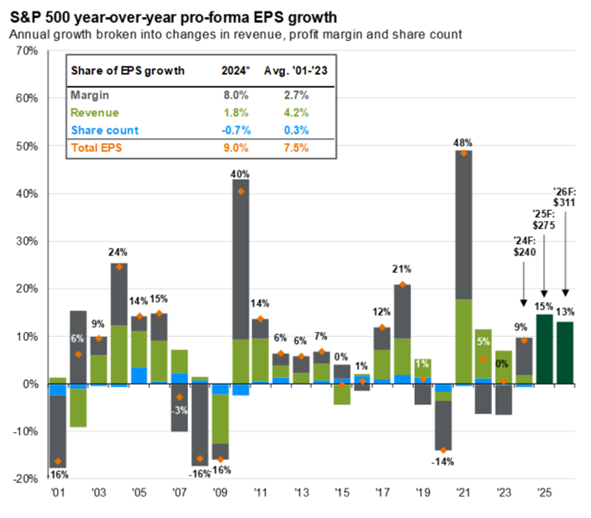

Next, the market’s expectations for earnings growth over the next 2 years are demanding. As shown in the chart below, the market is expecting earnings growth of 15% in 2025 followed by another 13% in 2026. Underpinning these expectations is the belief that, after 2 years of essentially no growth from companies outside of the Magnificent 7 tech companies, the rest of the market is finally ready to deliver double-digit earnings growth next year. Some skepticism on this assumption may be warranted.

Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management.

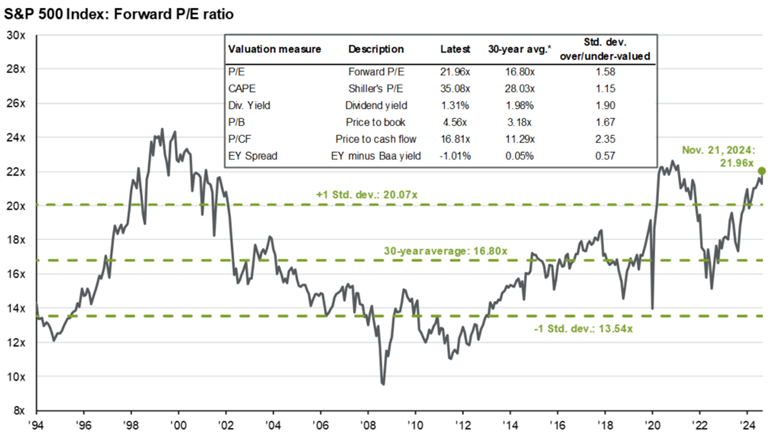

And finally, the price investors have been willing to pay for those earnings has rarely been higher, which means corporate America’s margin for error is slim in 2025.

Source: FactSet, FRB, Refinitiv Datastream, Robert Shiller, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management.

Valuations are a poor market timing indicator and tell us almost nothing about what the market will do over the next 12 months. So we are not calling for the end of the bull market in 2025 just because the market is expensive.

However, we are prepared for a year of digestion as we consolidate the extraordinary gains we’ve enjoyed over the last 2 years. The most plausible scenario to us would be a year where earnings are healthy but perhaps disappointing relative to high expectations, and the stock market delivers muted returns.

In our first blog, Ignore the Noise, we cautioned against making drastic portfolio changes based on near-term market views, and we stand by that advice. We continue to believe that long-term investors are best served by having an equity centric portfolio and sticking to the plan through the market’s ups and downs. However, modest rebalancing and taking some gains off the table at this juncture is probably warranted.

We also noted in that post to expect average rates of return in the coming years absent any unexpected macro shocks, despite high valuations. Since that writing on September 17th, the S&P 500 has already returned +8% which is in line with the average annual return of the stock market (only this time we got that +8% return in less than 3 months, illustrating how quickly this market has risen).

Where could we be wrong? The case for another banner year for stocks would likely include an acceleration in the profits generated by artificial intelligence, above and beyond what is priced in currently (in the early innings of innovation waves, it is common for the market to underestimate growth). And the case for a bear market would involve an exogenous shock that either derails the labor market or destabilizes the financial system (the most plausible culprit would be geopolitics, but it is usually the “unknown unknowns” that can cause the biggest problems).

Better days ahead for private markets

After 3 years in the basement, we believe that private markets should be a bright spot in 2025, especially relative to public markets.

Private markets have been stuck in neutral primarily because private equity and venture capital funds have had a hard time exiting their investments. Exits often drive increases in company value, and they allow the funds to return money to their limited partners, who then often recycle much of that money back into the system, which spurs deal activity.

Many have wondered why IPO activity has remained so subdued despite the S&P 500 notching all-time highs this year. There are a myriad of factors that explain the recent IPO draught, but here are a few of the top reasons:

- Many VC backed companies raised money at astronomical valuations 3-4 years ago and need more time to grow into these valuations

- The best companies in the private markets have large cash balances and many of them do not need to raise more money right now (and for those that do need to raise capital, there remains a lot of cash on the sidelines in private markets to fund these companies)

- While the S&P 500 index has performed well, the cohort of smaller software companies (which is the best direct comparison to VC backed companies) has been a laggard for much of the last 2 years

Points 1 and 2 simply take time, and it is unlikely that these issues fully resolve themselves in 2025. However, the cohort of smaller publicly traded software companies have finally shown signs of life in the last 2 months, and this may give VC backed companies some more confidence to test the IPO waters next year (the BVP Cloud Index, which tracks smaller software companies, is up +30.5% over the last 3 months and now up +19% over the last year). In fact, 9 of the last 10 tech IPOs have risen in value since their initial listing, and the median share price increase of these 10 companies has been +55%.

In addition, lower interest rates are a boost for private markets, and a lighter touch on antitrust regulation would provide additional exit paths for private companies who wish to be acquired by larger corporations rather than go public.

Finally, artificial intelligence is another potential catalyst for positive returns this year. Much of the value creation in artificial intelligence so far has accrued to the biggest companies that are building out the infrastructure for AI (Nvidia, Amazon, Microsoft, Google, etc.). In recent months this dynamic has started to broaden, as more businesses are now able to use the infrastructure put in place by the large companies to build AI applications (these are the tools and software that consumers/businesses will use on a daily basis to access AI). We are now seeing AI applications being launched at scale, mainly from enterprise software companies. The application layer of AI is still in its early stages and many of the top AI application companies still live in the private markets.

Concluding thoughts

We expect a solid economic backdrop, and therefore decent corporate earnings, in 2025. Expectations for the stock market are very high, so we are prepared for some level of volatility and perhaps disappointment in market returns next year (we would be thrilled if we are too cautious). If this scenario plays out, where earnings rise but the stock market underperforms, we would end 2025 with more reasonable valuations. In addition, we expect brighter days ahead for the private markets which should be a source of outperformance in 2025.

Wishing you and your families a Merry Christmas, Happy Holidays, and a successful 2025!