Analysis of the changing political and market landscape in 2025.

After taking a bullish view on markets throughout 2023 and 2024, our team entered 2025 with a much more cautious stance on the stock market. As we outlined in our 2025 Outlook, the set-up for stocks this year was tricky, and we expected a volatile year, but not a full blown bear market. When we published our 2025 outlook, the rest of the market was more optimistic, with many strategists expecting a strong year.

However, sentiment has shifted quickly, as it so often does, and we’ve experienced a sea change across a number of dominant market themes this year.

First, stock prices are no longer going up unabated as they did over the last two years. Additionally, two dominant market themes (the Magnificent Seven driving market returns, and US stocks trouncing international stocks) have reversed course this year.

Markets do not like uncertainty, and with a new sheriff in town in Washington, we have entered a period of change in US policies across a range of domains (fiscal policy, trade policy, and foreign policy have been early top priorities), which has left the market jittery. The stock market as a result has struggled so far in 2025, delivering a -3.7% year-to-date (and down -7.9% from the all-time highs set in mid February). Consumer and investor sentiment surveys also showed sizable declines in the last few weeks.

While we were rightfully cautious coming into the year, and remain cautious on the near-term outlook for markets, we also understand the benefits of staying the course in equities for long-term investors and are preaching patience. While rebalancing on the margins and building up additional cash is prudent right now, we are not advocating wholesale shifts in portfolios. Markets have weathered periods worse than today and we would not make a long-term bet against Corporate America finding a way to generate long-term earnings growth.

We dive into each of these segments of sea change below:

Impact of DOGE and tariffs on the economy

The comments and analysis below are neither an endorsement nor a criticism of the policy changes underway. Our job is not to opine on our support of, or opposition toward, these policies. Our job as investors is to understand what is happening, and how it may impact markets.

We have taken note of several comments and actions from the Trump administration that can impact the path for the economy in the near-term. We cite a recent Bloomberg report that give us a window into the strategy being taken by the Trump administration:

“Trump has famously obsessed with the stock market as a real-time referendum on his presidency. But now, with Musk and Treasury Secretary Scott Bessent in his ear at the start of his second term, much of the attention has shifted to another benchmark — the 10-year Treasury bond yield.

With good reason. As powerful as the Federal Reserve is, with its control of short-term rates, and as much sway as it has on stock market sentiment, it’s the 10-year Treasury rate that largely determines the cost of money for homebuyers and the biggest US companies.”

Treasury Secretary Scott Bessent made comments in a CNBC interview on Friday to the same effect:

“We’re trying to get [interest] rates down and could we be seeing that this economy that we inherited starting to roll a bit? Sure, and there’s going to be a natural adjustment as we move away from public spending to private spending. The market and the economy have just become addicted to government spending and there’s going to be a detox period.”

These types of statements, taken in conjunction with tariffs announcements and aggressive attempts to cut government spending, lead us to the conclusion that the Trump administration is not concerned with short-term economic weakness, nor stock market weakness, during this “adjustment period”. They believe their track record starts toward the end of this year, where they anticipate that tax policy, deregulation, and growth in manufacturing will lead to a recovery in growth.

This explains why the sequencing of their policy rollout differs from Trump’s first term in office. In his first term, Trump 1.0 started with tax reform in 2017 (a strong year for markets as a result), and then enacted their tariff policy in 2018 (a negative year for stocks as a result).

This time around, less market friendly policies have come first, and that has hit consumer and investor sentiment, as well as Q1 GDP forecasts (Q1 GDP estimate from the Atlanta Fed is now showing -2.4%, down from +2.3% two weeks ago).

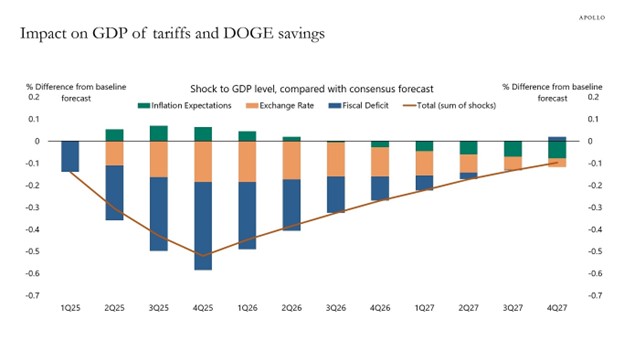

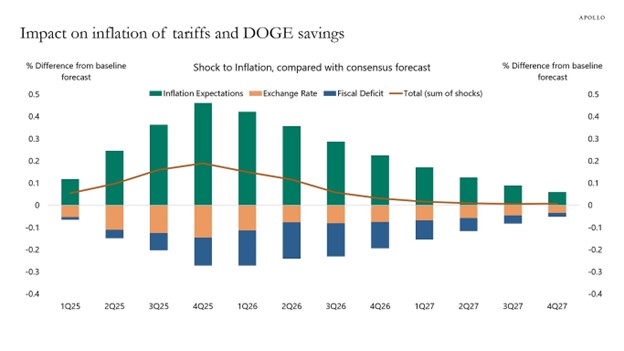

We think it is instructive to take a data driven approach to analyzing the financial and economic impacts of these policies. Apollo’s Chief Economist shared an analysis on how tariffs and government spending cuts could impact both economic growth and inflation in the short-term. In summary, his analysis results in a -0.5% hit to GDP growth, and a +0.2% impact to inflation, both of which subside over the next 2 years.

While these figures are net negatives for the economy in the short-term, they are somewhat modest, and unto themselves do not equate to recessionary figures. However, we are not ruling out a recession, as the magnitude of the domino effect from these new policies is difficult to forecast.

What we can say is that the stock market continues to trade at high valuations (more on that below) with robust earnings expectations, so any bad news will hurt stocks. Despite the recent sell-off, we do not think this is a great buying opportunity just yet. At some point, if stock prices fall enough, there will be attractive buying opportunities, but we are not there yet.

Note: Assuming $100bn in DOGE savings resulting in 0.4% reduction in fiscal deficit, 5% appreciation of exchange rate, and 0.5% pt increase in inflation expectations shocks applied in Q1 2025. Source: Bloomberg SHOK model, Apollo Chief Economist

Earnings have been strong but guidance for 2025 earnings were a disappointment

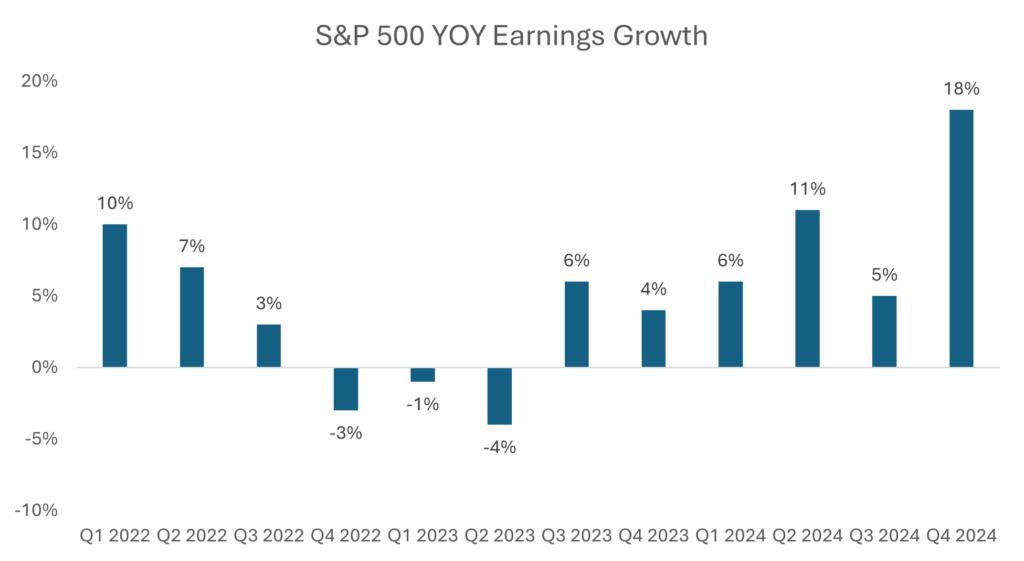

Corporate America just had its best quarter of earnings since Q4 2021, delivering a staggering +18% year-over-year growth rate (vs. 12% expected).

These strong results further underscore that the US economy remained on solid footing throughout Q4. So far in 2025, consumer spending remains healthy and corporations continue to spend heavily on capital expenditures. But, as we noted above, these figures could adjust downward in the near-term as a result of public policy adjustments.

However, expectations were incredibly high coming into 2025. The forward P/E ratio for the S&P 500 was 22x (high relative to history) and the market expected earnings growth of +14.7% this year. In other words, even if Corporate America delivered a robust +10% earnings growth rate for the year, it would be a disappointment to the market.

That is what has played out so far this year. On the heels of Q1 earnings reports, expectations for earnings growth for calendar year 2025 have dropped from +14.7% to +11.6%. This still represents strong growth, but this is not good enough when the market trades at 22x earnings and expects more.

We have not seen enough of a reduction in valuations, nor earnings expectations, to change our cautious view. We still believe that prices are a bit too high, and expectations remain elevated.

While the AI buildout is still in the early innings, the Magnificent Seven have taken a breather

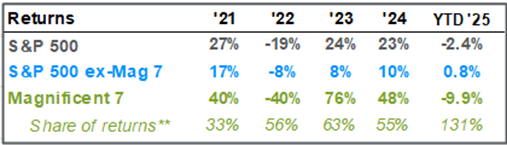

After two years of dominant performance, the Magnificent Seven technology stocks have been laggards so far in 2025.

As of March 6, 2025

The clear turning point was the release of a Chinese built artificial intelligence model, DeepSeek R1, which called into question some of the lofty AI expenditures being made by America’s technology giants, as this model performed on par with OpenAI’s ChatGPT at a much lower computing cost (and it was released open source, unlike ChatGPT).

Prior to release of DeepSeek R1 on January 22nd, the Mag7 stocks had kept pace with the rest of the market in January. Since the release, the Mag7 is down -17% while the S&P 500 is down -7%.

However, it is difficult to conclude at this time that the party is definitively over for these companies. Many analysts and investors we speak with regularly tell us that AI spending will continue, and that the DeepSeek breakthrough could lead to even more spending on AI infrastructure, not less.

What this last month does tell us is that, again, the bar is extraordinarily high for these companies so even strong fundamental performance can be viewed as a mild disappointment (the Mag7 traded at 30x forward earnings, with expected growth north of 20% this year).

With this backdrop, these stocks are priced for perfect outcomes, and any imperfection can lead to volatility. However, over the long-term, we would not bet against the companies at the forefront of one of the biggest innovation waves in decades.

Despite recent outperformance of non-US stocks, we still prefer US equities over the long-term

One surprise this year has been the outperformance of non-US stocks (non-US stocks have delivered a +6.3% return this year vs. -3.7% for the S&P 500). While some may point to US policy adjustments as the catalyst, we also point to the simple fact that US stocks held high valuations and high expectations for earnings growth, while expectations for international stocks were low coming into the year. These mean reversion trades come about every few years, and can often be significant in the short-term.

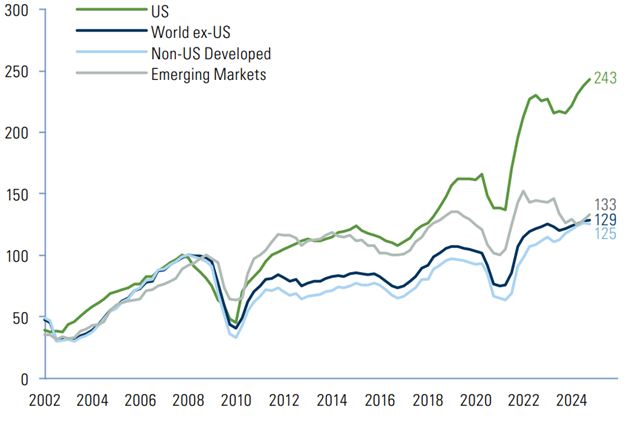

However, we continue to believe that the path of corporate earnings relative to expectations, as well as the price we are paying for that earnings stream, will be the biggest drivers of long-term performance, and therefore we continue to prefer US equities vs. international stocks. US companies have generated superior earnings and lower volatility of those earnings than companies outside the US. As shown below, US companies have grown their earnings at a much higher rate than non US companies since 2002.

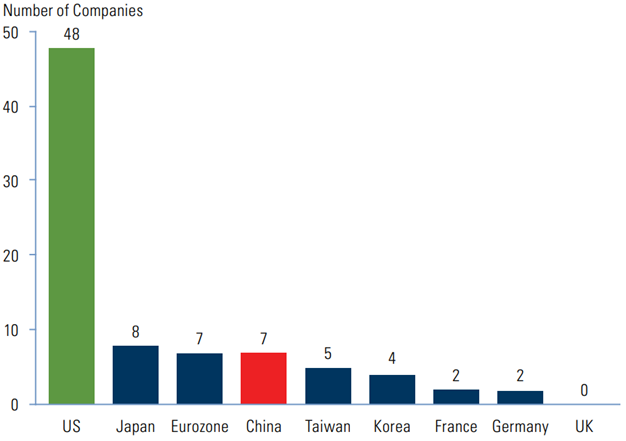

There are fundamental reasons for this outperformance in earnings. US companies are the biggest drivers of innovation in the global landscape. As discussed previously, innovation drives earnings growth, and earnings growth drives stock market performance.

As shown below, the US has more technology companies generating $1bn of profit than the rest of the world combined.

This year, expectations were so high for US stocks, and so low for non-US stocks, that it is not surprising to see some reversion to the mean, and we may see further outperformance in non-US stocks for the next several months as expectations recalibrate.

However, until we see other regions catch up to the US on innovation, we continue to prefer an overweight to US equities for long-term investors.